Menu / Client Maintenance / Client Parameters / Basic Parameters

Basic Parameters

The Basic Parameters page includes all details which are used to set up a client. You may edit and set up the preferences for a client.

|

Table of Contents |

Navigation: Client Maintenance → Client Parameters → Basic Parameters

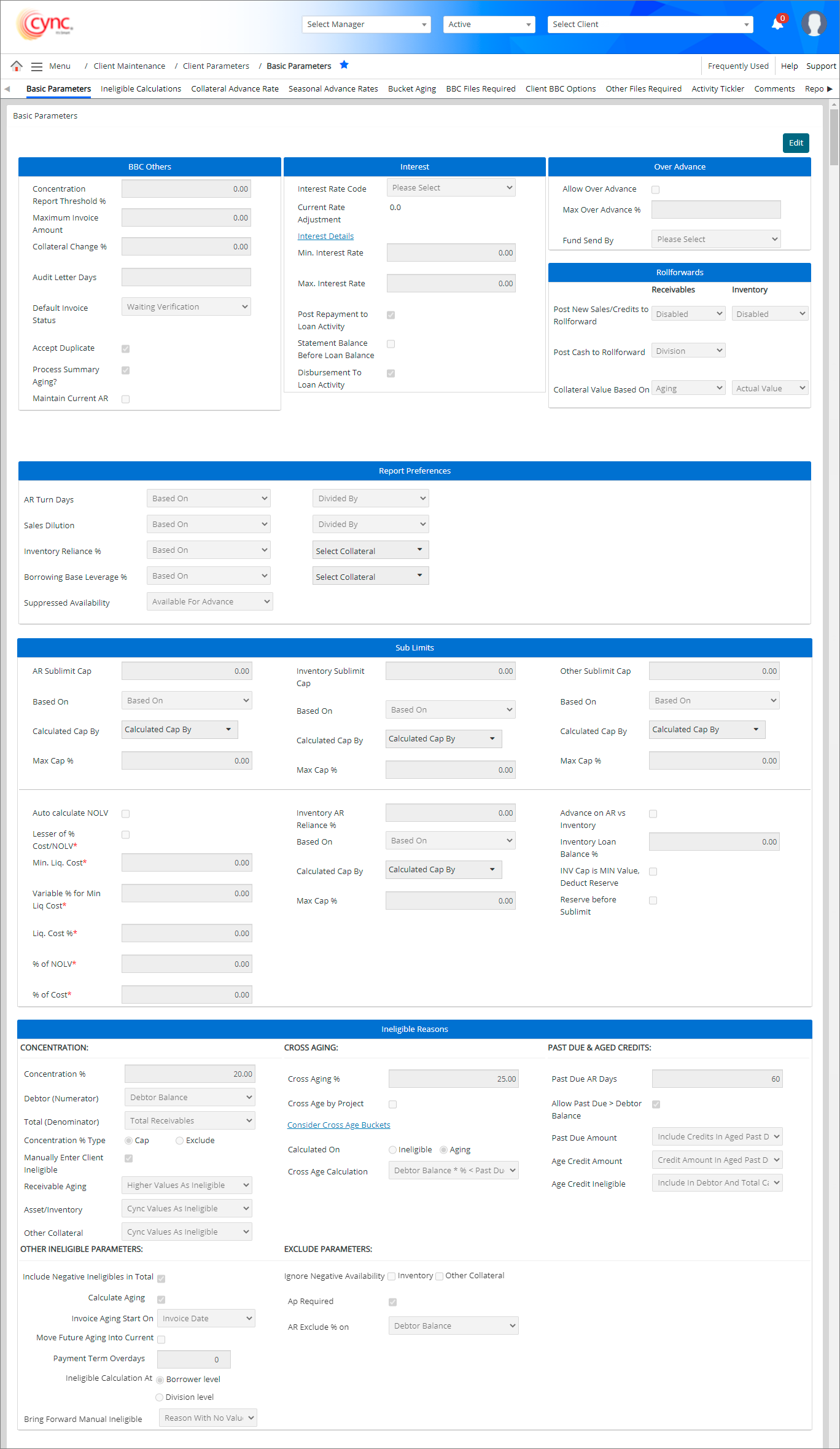

Refer to the screenshot:

To set up basic parameters for a client, perform these steps:

1. In the Select Client ![]() field, select the client.

field, select the client.

2. Go to Menu → Client Maintenance → Client Parameters → Basic Parameters.

3. Click the ![]() button.

button.

4. Edit the fields as required.

5. Click the ![]() button to save the confgured fields.

button to save the confgured fields.

A borrowing base is the amount of money a lender will loan to a company based on the value of the collateral the company pledges. The borrowing base is usually determined by a method called margining, in which the lender determines a discount factor that is multiplied by the value of the collateral. The result is the amount that will be loaned to the company for a particular period.

Fields and Descriptions

|

Fields |

Descriptions |

Examples |

|

Concentration Report Threshold % |

This field allows you to set a concentration limit when running reports. |

Example: If you enter 25% then debtors/vendors exceeding 25% will show up on a concentration report. |

|

Maximum Invoice Amount |

This field allows you to set limits on invoices which automatically sends those to the verification process. |

Example: If Maximum Invoice Amount = 1000. Those debtor invoices which exceeds the defined Maximum Invoice Amount >=1000 and verification letter is defined, then the list of debtors can be viewed for Verification letter type filter under Letters page. |

|

Collateral Change % |

This field allows you to establish a limit that will trigger an email notification to the lender if collateral changes exceed the percentage entered. |

Example: If Total Available For Advance from last Approved BBC is greater than or lesser than the Total Available For Advance from current BBC, then the Email notification gets triggered for Collateral Change percentage.

The calculation is as follows, A = Total Available For Advance in Last approved BBC B = Total Available For Advance in Current BBC Change in collateral percentage = ((A-B)/A) * 100 Email notification will not get triggered in the following conditions:

|

|

Audit Letter Days |

This is used for both Factoring and ABL module. This field allows you to establish the number of days ahead to notify the borrower about an upcoming audit. |

Example: If you enter 30, then Cync will send an audit letter 30 days before the audit is due. |

|

Default Invoice Status |

This is used for the Factoring module only and does not apply to ABL. This field is used with the invoice verification process. Select from the drop down menu the default setting you would like to use. |

Example: If you select ‘Waiting Verification’ then all invoices will be set to this status until someone verifies that it is ok to proceed and changes the status. |

|

Accept Duplicate |

This field is only relevant when processing AR details (the ‘Process Summary Aging’ flag should not be checked).

|

|

|

Process Summary Aging |

Select the checkbox, if you are processing summary aging only. |

Example: If the flag is checked then it means you will not be processing detailed aging. |

|

Maintain Current AR |

Select the checkbox, if you would like to maintain AR data including daily sales and cash transactions. |

The interest is the term which is calculated on the basis of the amount paid regularly by borrower to the lender at a particular rate of percentage for the use of money lent, or for delaying the repayment.

You can edit the fields which are available under interest section, for that users’ needs to click on the fields which are available under interest section under basic parameter page and edit and save the changes for reference user can refer below mentioned field table and descriptions with examples and the image.

|

Fields |

Descriptions |

|

Interest rate code |

Select the type of interest rate code from drop down list |

|

Current rate adjustment |

The value will be default calculated based upon rate of interest margin added on top of interest rate code |

|

Min. interest rate |

Enter the min interest rate |

|

Max. Interest rate |

Enter the max interest rate |

|

Post repayment to loan activity |

Select the checkbox if post payment activity is done to a particular loan activity. |

|

Statement Balance Before Loan Balance |

The option is applicable only for Accrue to Statement preference. For more information related to Accrue to Statement calculations, refer to Accrue to Statement.pdf If you select the checkbox, then there is no option to manually enter the payment details under Interest Payment page. The manual payment entry option is disabled. Clear the checkbox to manually add the multiple payments under Interest Payment page. |

|

Disbursement to loan activity |

Select the checkbox, if disbursement to loan activity is required |

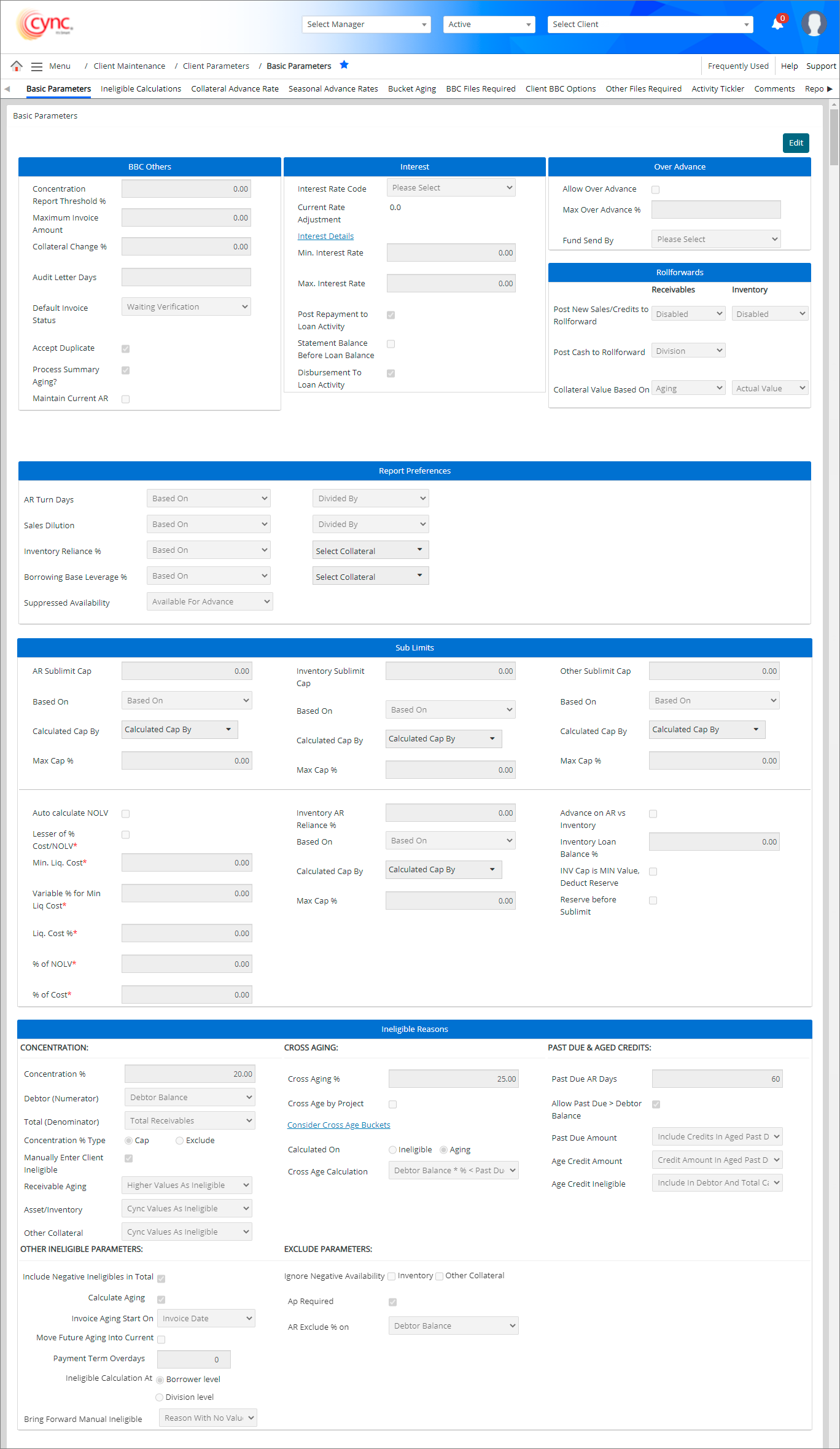

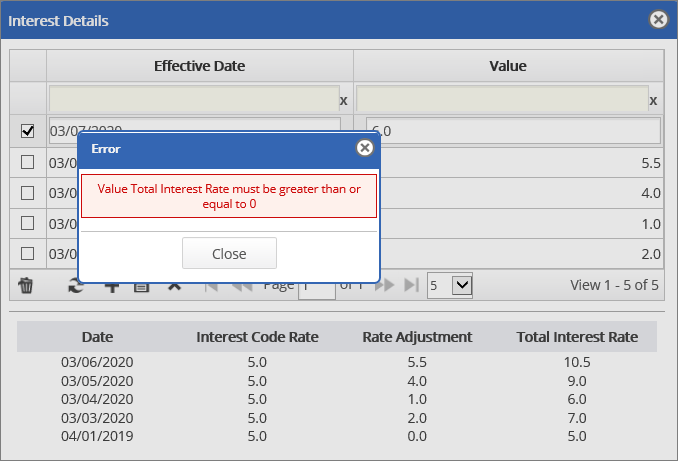

Interest Details link allows the user to add and delete the positive rate adjustment value in Basic Parameter page.

You may also add the negative rate adjustment value in Basic Parameter page only if the Interest Code Rate value is greater than the rate adjustment value. The created rate adjustment value will also reflect in Interest Details link under Loan Setup page.

Refer to the screenshot:

Fields and Descriptions:

|

Fields |

Descriptions |

| Date |

Displays the start date of the rate adjustment value. |

|

Interest Rate Code |

Displays the Interest rate code value. |

|

Rate Adjustment |

Displays the rate adjustment value. |

|

Total Interest Rate |

Displays the total sum value of Interest Rate Code and Rate Adjustment. |

To add Interest details, perform these steps:

1. Click  icon to add new interest details.

icon to add new interest details.

2. In Effective Date column, select the start date for the interest rate adjustment.

3. In Value column, enter the rate adjustment value.

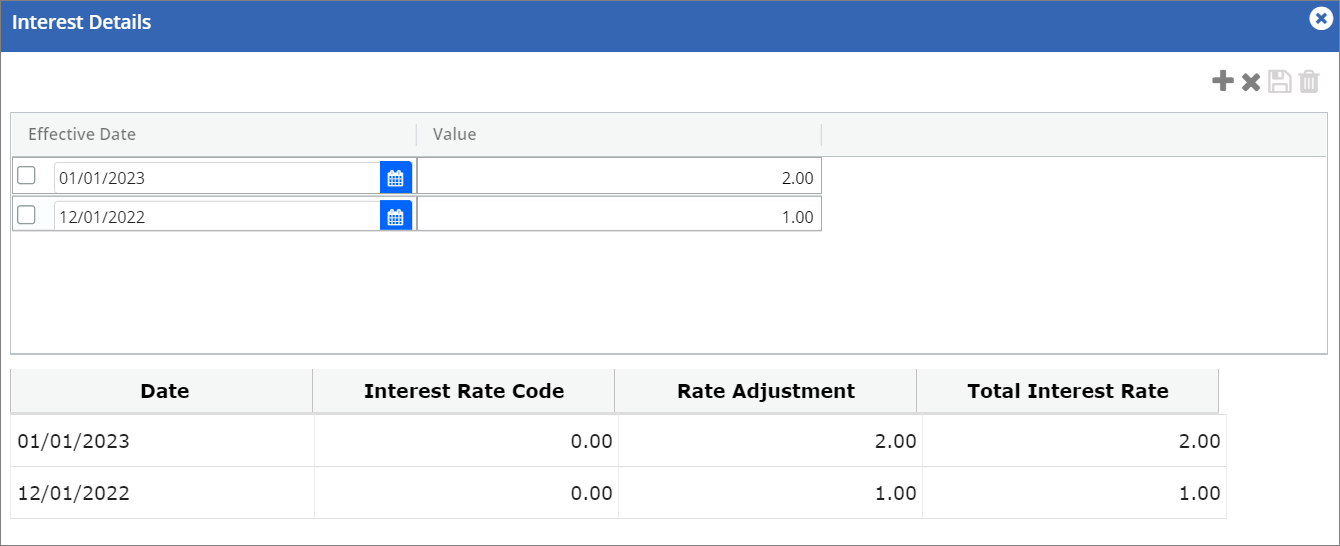

4. Click  button. The Interest rate adjustment value is successfully created and a success message “Rate Adjustment was successfully created" appears.

button. The Interest rate adjustment value is successfully created and a success message “Rate Adjustment was successfully created" appears.

Refer to the screenshot:

Negative values should not be allowed to add as adjustment amount for the previous periods if the interest is set as Accrued to Loan/accrued to statement.

Negative values should not be allowed to add as adjustment amount for the previous periods if the interest is set as Accrued to Loan/accrued to statement.

When user enters the negative Rate Adjustment value on specific date on which total Interest rate become negative, the system shows an error notification.

Refer to the screenshot:

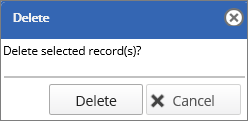

To delete interest details, perform these steps:

1. In Effective Date column, select the interest rate adjustment value that you wish to delete.

2. Click ![]() button. A delete pop-up window appears.

button. A delete pop-up window appears.

Refer to the screenshot:

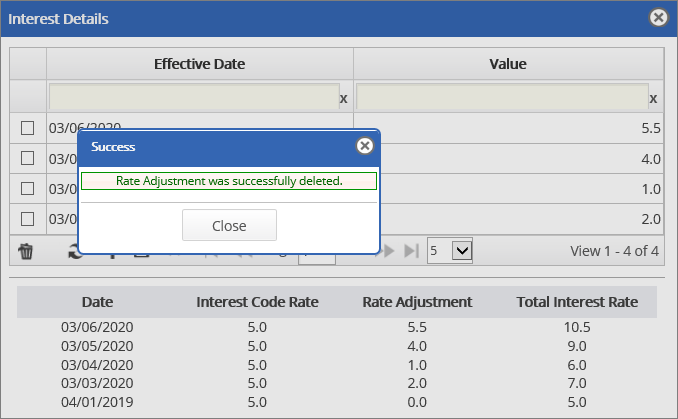

3. Click  button. The interest rate adjustment value is successfully deleted and a success message “Rate Adjustment was successfully deleted" appears.

button. The interest rate adjustment value is successfully deleted and a success message “Rate Adjustment was successfully deleted" appears.

Refer to the screenshot:

A short-term commercial loan taken by a company in order to purchase more materials for its inventory in preparation for an expected period of increased sales. An over advance is used to build inventory prior to a peak sales period. The loan amount taken out by the company temporarily exceeds its (borrower's) accounts receivables; the loans are generally commercial, and are usually short-term ranging from 30 days to one year.

You can edit the fields which are available under in over advance section, for that you need to click on the fields which are available under in over advance section under basic parameter page and edit and save the changes for reference you can refer below mentioned field table and descriptions with examples and the image.

Fields and Descriptions

|

Fields |

Descriptions |

|

Allow Over Advance |

Check in if allow over advance is required. |

|

Max Over Advance % |

Enter the percentage of maximum over advance |

|

Fund Send By |

Select fund send by method from drop down list |

Rollforward rolls the balance from the prior BBC period and adds all the new sales, new Credits, new cash collected and new Adjustments after every BBC Recalculation process either in Collateral level or Division level.

The Rollforward enables all the details of the receivables to be shown in the Receivables Rollforward page.

You may edit the fields which are available under Rollforwards section, for that you need to click on the fields which are available under in Rollforwards section under basic parameter page and edit and save the changes for reference you can refer below mentioned field table and descriptions with examples and the image.

|

Fields |

Descriptions |

Examples |

| Post New Sales/Credits to Rollforward |

This field allows you to post new cash or repayment to the roll forward based on the selected option. It includes the following options:

|

|

|

Post Cash to Roll Forward |

This field allows you to post the cash or repayment to roll forward based on the selected option when the repayment is made either through Cash Application or through Collateral Loans page by creating a manual entry data or through Map & Uploads page. It includes the following options ;

|

Example:

1. If the cash type is By Debtor and Division option is selected, then the cash is posted to the respective division of the defined debtor's parameter. Let us consider an instance, if the selected debtors parameter is Receivable 2 which is linked with Division 1, then the cash is posted in Division 1 under Rollforward section once the batch is processed.

2. If the cash type is By Debtor and Collateral option is selected, then the cash is posted to the respective collateral of the defined debtor’s parameter. Let us consider an instance, If the selected debtor’s parameter is receivable 2 which is linked with collateral 2 of division2, then the cash is posted under roll-forward section in division 2 of collateral 2 once the batch is processed.

3. If the cash type is By Debtor and All option is selected, then the cash is posted to all the divisions once the batch is processed.

4. If the cash type is By Bulk and Division option is selected, then the cash is posted to the respective division once the batch is processed.

5. If the cash type is By Bulk and Collateral option is selected, then the cash is posted to the respective Collateral once the batch is processed.

6. If the cash type is By Bulk and All option is selected, then the cash is posted to the all the divisions once the batch is processed.

7. If the cash type is By Bulk and None option is selected, then the cash is not posted to the Rollforward.

8. If the cash type is By Invoice and Division option is selected, then the cash is posted against the invoice’s parameter linked with respective division once batch is processed. Let us consider an instance, If the selected invoice’s parameter is Receivable 3 which is linked with Division 3, then the cash is posted under roll-forward section in division 3 and same should show under “ALL” option as summed up with all divisions Amounts once the batch is processed.

9. If the cash type is By Invoice and Collateral option is selected, then the cash is posted against the invoice’s parameter linked with respective collateral once batch is processed. Let us consider an instance, If the selected invoice’s parameter is Receivable 1 which is linked with Collateral 1 of Division 1, then the cash is posted under roll-forward section in Collateral 1 once the batch is processed.

10. If the cash type is By Invoice and All option is selected, then the cash is posted against the invoice’s parameter linked with all divisions once batch is processed.

|

|

Collateral Value Based On |

Receivables: The Receivables section has the following options:

Inventory: The Inventory has the following options:

|

Example: Receivables:

1. If the Rollforward option is selected: The unreconciled value shows the difference amount of Receivables Aging Total and EOP Total under Receivables Rollforward page. Let us consider an instance, Receivables Aging Total is 10000; EOP Total is 6000. Unreconciled value = 10000-6000 = 4000.

2. If the Aging option is selected: The EOP Total value and Receivables Aging Total value will be same. Let us consider an instance. Receivables Aging Total is 20000; hence EOP Total will also be 20000; Prior AR is 0.00; New Sales (Additions) is 2000; New Credits is 3000; New Cash Collected is 500; New Adjustments is 1000; BBC Adjustments is 5000. Unreconciled = 20000-0.00-2000+3000+500+1000-5000 =17500.

For more information about the formula of Unreconciled and EOP Total values, please refer to Receivables Rollforward page.

Inventory:

1. If the Rollforward option is selected: The unreconciled value shows the difference amount of Asset/Inventory Actual Value and EOP Total under Inventory Rollforward page. Let us consider an instance, Asset/Inventory Actual value is 110000; EOP Total is 12000. Unreconciled Value = 110000 - 12000 = 98000.

2. If the Actual Value option is selected: The EOP Total value and Asset/Inventory Actual value will be same. Let us consider an instance, Actual value (from Asset Inventory page) is 20000; Hence EOP Total will also be 20000; Prior Balance is 0.00; Purchases is 2000; Credits is 3000; Removals is 500; Adjustments is 1000; BBC Adjustments is 5000. Unreconciled = 20000-0.00-2000+3000+500+1000-5000 = 17500. For more information about the formula of Unreconciled and EOP Total values, please refer to Inventory Rollforward page.

|

Rollforwards

Rollforward rolls the balance from the prior BBC period and adds all the new sales, new Credits, new cash collected

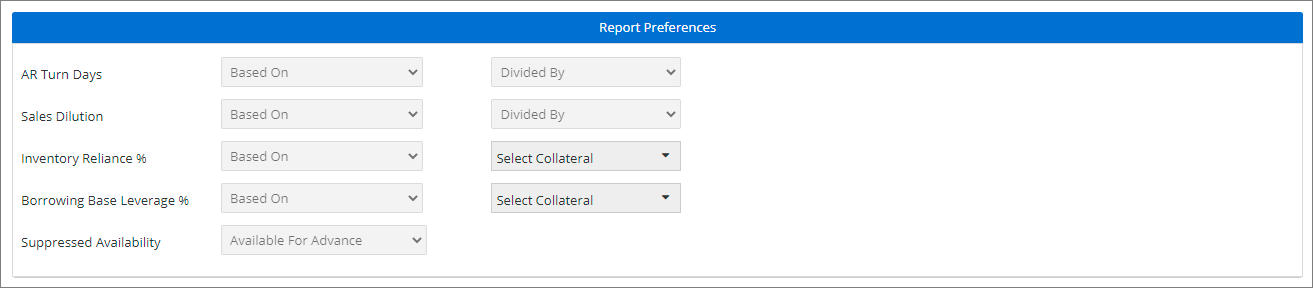

Report Preferences

The Report Preferences allows to define the report preferences and choose collateral types, based in which AR Turn Days, Sales Dilution, Inventory Reliance % and Borrowing base Leverage % are calculated for Management reports. The system calculates the Inventory Reliance % and Borrowing base Leverage % based on the selected collateral types and report preferences.

Refer to the screenshot:

Fields and Descriptions:

|

Fields |

Descriptions |

|

AR Turn Days |

Specifies the report preference for AR Turn Days. Select the preference from the drop-down menu. The Based-on preference includes the following options:

The Calculated by includes the following options:

|

|

Sales Dilution |

Specifies the report preference for Sales Dilution. Select the preference from the drop-down menu. The Based-on preference includes the following options:

The Calculated by includes the following options:

|

|

Inventory Reliance % |

Specifies the report preference for Inventory Reliance. Select the preference and from the drop-down and choose collateral type. It includes the following options:

If the Inventory Reliance % is set as Based On under Report Preferences, the system will not display the Inventory Reliance % parameter in the BBC Executive Trend Report for all the BBCs of selected ABL client. If the Inventory Reliance % was set as anyone of the option other than Based On for few BBCs initially and later on it was changed to Based On for next BBCs, the system will consider Based On only in Report Preferences and will not display the Inventory Reliance % parameter in the BBC Executive Trend Report for all the BBCs (including previous BBCs) of selected ABL client. Inventory Reliance % is calculated as follows: Inventory Reliance %: (((O/S Loan Balance/ Letter Of Credit/ Loan Reserves) - Based on Selected Collateral in Report Preference)/ (O/S Loan Balance/ Letter Of Credit/ Loan Reserves))*100 |

|

Borrowing Base Leverage % |

Specifies the report preference for Borrowing Base Leverage%. Select the preference and choose collateral type. It includes the following options:

If the Borrowing Base Leverage % is set as Based On under Report Preferences, the system will not display the Borrowing Base Leverage % parameter in the BBC Executive Trend Report for all the BBCs of selected ABL client. If the Borrowing Base Leverage % was set as anyone of the option other than Based On for few BBCs initially and later on it was changed to Based On for next BBCs, the system will consider Based On only in Report Preferences and will not display the Borrowing Base Leverage % parameter in the BBC Executive Trend Report for all the BBCs (including Previous BBCs) of selected ABL client. Borrowing Base Leverage is calculated as follows:

Borrowing Base Leverage % = ((O/S Loan Balance/Letter Of Credit/ Loan Reserves)/ Based on Selected Collateral)*100 . For example,If Selected Preference is Total Availability for Advance, Borrowing Base Leverage %= ( O/S Loan Balance/Letter Of Credit/ Loan Reserves )/ Total Availability for Advance. The calculated value can be viewed under respective Management reports. |

| Suppressed Availability |

Specifies the report preference for calculating the Suppressed Availability of AR, Inventory, Other Collateral for respective history (approved) BBC’s in BBC Executive Trend Report and BBC Trend Report pages. Select the preferences which include the following options:

The default option would be always Available For Advance.

For example, (1) If Suppressed Availability in Report Preference selection is selected as Available; and if AR Available is greater than Net A/R Available For Advance for the BBC, then the A/R Suppressed Availability value will be calculated as AR Available - Net A/R Available For Advance; otherwise the A/R Suppressed Availability value will be “0.00” in BBC Executive Trend Report and BBC Trend Report pages. (2) If Suppressed Availability in Report Preference selection is selected as Borrowing Base; and if AR Borrowing Base is greater than Net A/R Available For Advance for the BBC, then the A/R Suppressed Availability value will be calculated as AR Borrowing Base - Net A/R Available For Advance; otherwise the A/R Suppressed Availability value will be “0.00” in BBC Executive Trend Report and BBC Trend Report pages. (3) If Suppressed Availability in Report Preference selection is selected as Available For Advance; and if AR Available For Advance is greater than Net A/R Available For Advance for the BBC, then the A/R Suppressed Availability value will be calculated as AR Available For Advance - Net A/R Available For Advance; otherwise the A/R Suppressed Availability value will be “0.00” in BBC Executive Trend Report and BBC Trend Report pages. Similarly, the Inventory Suppressed Availability and the Other Collateral Suppressed Availability values will be calculated by fetching the Inventory and Other Collateral ( Available, Borrowing Base, Available For Advance) values respectively like same as AR which is mentioned in the above example (i.e Available, Borrowing Base, Available For Advance by comparing with their Net Available for advance); and those Calculated values will be shown in their respective fields under BBC Executive Trend Report and BBC Trend Report pages. |

From the Select Collateral drop-down, choose the Collateral types for both Inventory Reliance % and Borrowing Base Leverage%. It includes

Based on the specified formula, the system calculates the Inventory Reliance % value and Borrowing Base Leverage % value. The same value can be viewed under respective Management Reports.

Based on the specified formula, the system calculates the Inventory Reliance % value and Borrowing Base Leverage % value. The same value can be viewed under respective Management Reports.

Sub limit refers to the maximum amount of credit or debit, a financial institution extends to a client through a line of credit or debit as well as the maximum amount a company allows a borrower to spend. Lenders usually set sub limits based on information in the application that has been received from borrower.

You can edit the fields which are available under BBC section, for that users’ needs to click on the fields which are available under sub limit section under basic parameter page and edit and save the changes for reference user can refer below mentioned field table and descriptions with examples and the image.

Cync calculates the AR Reliance %, Loan Balance %, AR Sublimit Cap and Inventory Sublimit Cap and apply the lesser of the four calculations. You can enter a direct sublimit amount to use with "Based On" and "Calculated Cap By" options.

Cync calculates the AR Reliance %, Loan Balance %, AR Sublimit Cap and Inventory Sublimit Cap and apply the lesser of the four calculations. You can enter a direct sublimit amount to use with "Based On" and "Calculated Cap By" options.

The options for Based On are:

The options for Calculated By are:

Fields and Descriptions

|

Fields |

Descriptions |

|

AR sublimit cap |

This allows you to set a cap or an acceptable limit for AR when comparing with the receivables collateral value. |

|

Max Cap % |

The allows you to set maximum limit allowed or eligibility for AR. |

|

Inventory sublimit cap |

Applies to inventory only. This allows you to set a cap or an acceptable limit for uploaded inventory data. Note: The value calculated by each marked with an asterisk will be compared to each other and the least amount will be used as the “Inventory Collateral” In the BBC. |

|

Max Cap % |

The allows you to set maximum limit allowed or eligibility for Inventory. |

|

Other sublimit cap |

This allows you to set a generic cap or an acceptable limit for anything else. |

|

Max Cap % |

The allows you to set maximum limit allowed or eligibility for other sublimit. |

|

Auto calculate NOLV |

Applies to inventory only. If this flag is checked, Cync will Calculate Net Orderly Liquidation Value of inventory. |

|

Lesser of cost /NOLV |

Applies to inventory only. Liquidation cost as a % of inventory |

|

Min liq cost |

Applies to inventory only. This allows you to enter the minimum amount you would like to use when calculating liquidation cost. |

|

Variable % for min liq cost |

These values are predefined in the application user cannot edit or enter the variable % for min liq cost % |

|

Liq cost% |

These values are predefined in the application user cannot edit or enter the liq cost % |

|

% of NOLV |

Applies to inventory only. Enter the percentage you would like to use when Cync is calculating NOLV. |

|

% of cost |

Applies to inventory only. Enter the percentage you would like to use when Cync is calculating NOLV. |

|

Inventory AR Reliance% |

Applies to inventory only. This allows you to place a cap or an acceptable limit of Total AR. (Total AR * AR Reliance %). |

|

Max Cap % |

The allows you to set maximum limit for Inventory AR Reliance%. If Inventory AR Reliance% and Max Cap % are defined, then the system considers minimum of both. For example, if the calculated Inventory sublimit is 10000 and AR Reliance is 6000, then the system considers AR Reliance value as net available advance for Inventory. For more information, refer to Asset/Inventory page to view the calculations. |

|

Advance AR vs Inventory |

Applies to inventory only. If the flag is unchecked, Inventory Reserve will be deducted from the Inventory Cap amount calculated. |

|

Inventory Loan Balance |

Applies to inventory only. This allows you to place a cap or an acceptable limit of the total loan balance (Current Loan Balance * Loan Balance %). |

|

INV Cap is MIN Value, Deduct Reserve |

This field allows user to deduct or not deduct Reserve from “Total Inventory Available For Advance”. In flag ON case: if Total Inventory Sublimit value under BBC Availability page is lesser than the values of Inventory Available for Advance, Inventory AR Reliance % and Loan Per Cent ( % ), then the Total Inventory Reserve value will be deducted from “Total Inventory Available For Advance”. In flag OFF case: if Total Inventory Sublimit value is lesser than the values of Inventory Available for Advance, Inventory AR Reliance % and Loan Per Cent ( % ), then the Total Inventory Reserve value will NOT be deducted from “Total Inventory Available For Advance”. |

|

Reserve Before Sublimit |

If the flag is OFF, Reserve for all the collateral gets considered for calculation only after applying Sublimit under BBC Availability page. If the flag is ON, the positions of Reserves and Sublimits will be swapped and Reserve will be calculated and displayed before Sublimit for all the Collaterals under BBC Availability page and Reserves will be deducted from Inventory Available under Assets/Inventory page. This field is editable even if the client has approved BBCs but BBC recalculation process is required in order to update the changes.

|

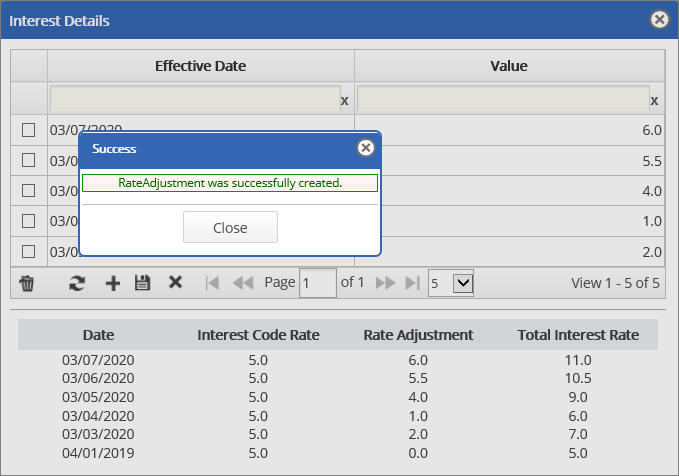

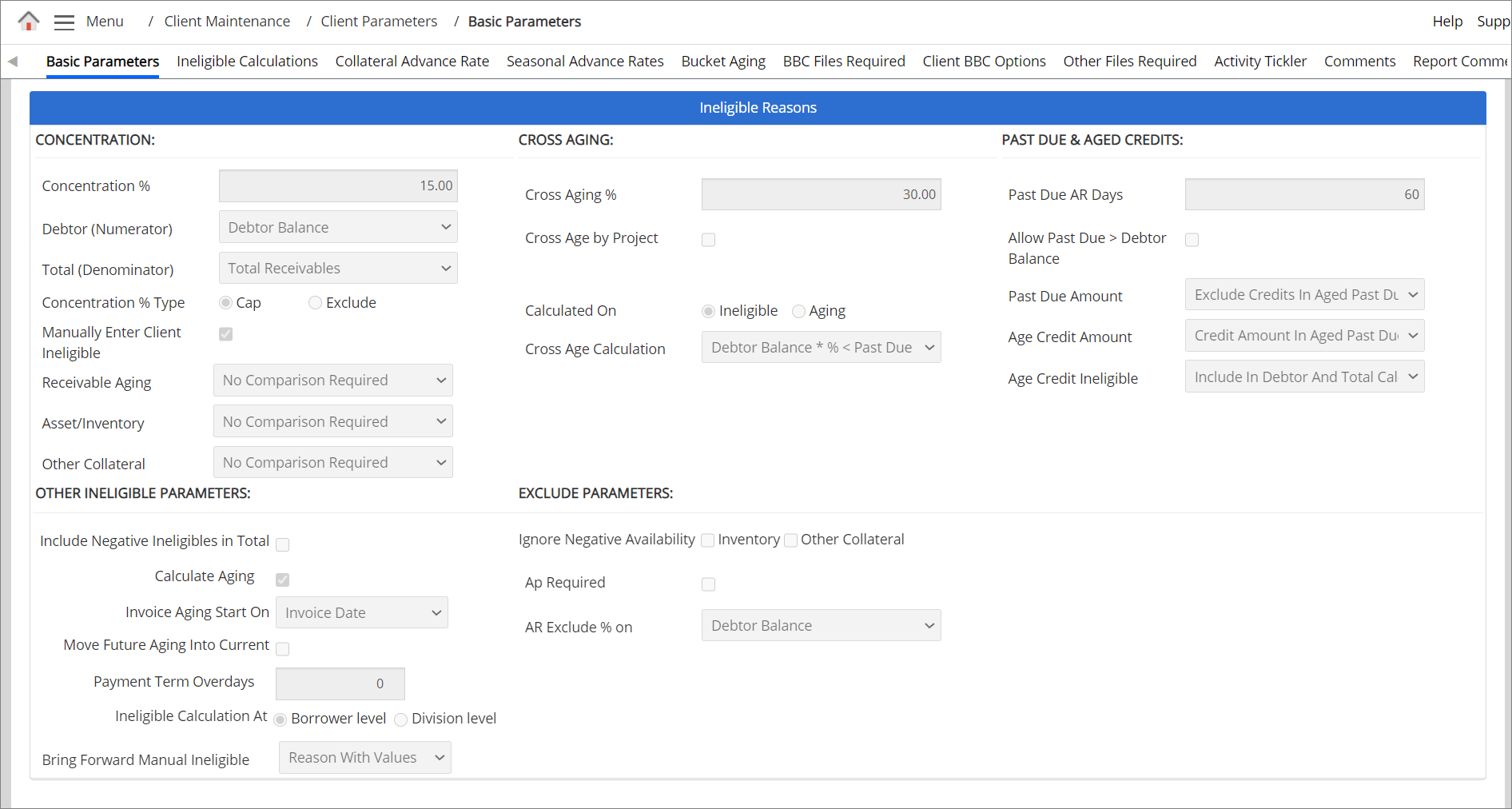

To edit the fields in the Ineligible Calculations section, navigate to the Basic Parameter page.

Click on the specific fields within the Ineligible Calculations section that you wish to modify, make the necessary changes, and save them.

For reference, you can consult the table below, which provides field descriptions and examples, along with the accompanying image for clarification.

Refer to the screenshot:

Fields and Descriptions

|

Fields |

Descriptions |

|

Concentration % |

The concentration (%) limits the total client's receivables as ineligible when it exceeds the provided (%) value. Concentration % at client level = Debtor’s receivable total/Client's total receivables *100

Concentration % at portfolio level = (Portfolio debtor total/Portfolio client total) * 100

|

|

Debtor (Numerator) |

The option allows you to select a default variable, based on which the system calculates the concentration % value. It includes Debtor Balance and Eligible Balance. |

|

Total (Denominator) |

The option specifies the total balance amount of all debtors receivables. |

|

Concentration % Type |

If you select ‘Cap’, then the eligible amount for the client’s receivables are capped at the Concentration %.

If you select ‘Exclude’, then all receivables will be considered ineligible. If the receivables are greater than the Concentration % entered, then all receivables is considered as ineligible.

|

|

Select this checkbox to view the client’s ineligibles (manual) and Cync Ineligibles (manual/ system defined) in the system automatically. This option allows you to view the client's /Cync ineligibles in the Receivable Aging page and display the ineligible amount based on the collateral name selected.

If this checkbox is disabled, there will be only one column i.e.,Ineligible Amount for each ineligibles and that ineligible amount gets considered as Cync ineligible amount.

|

|

|

Receivable Aging |

The option is available only when Manual Enter Client Ineligible checkbox is enabled. It includes the following options:

|

|

Asset/Inventory |

The option is available only when Manual Enter Client Ineligible checkbox is enabled. It includes the following options:

|

|

Other Collateral |

The option is available only when Manual Enter Client Ineligible checkbox is enabled. It includes the following options:

|

|

Cross Aging% |

This allows you to establish the percentage to be used for cross-aging. When past due receivables exceed a given percentage of a debtor's Total AR, the current available balance is also considered as ineligible.

|

|

Cross Age by Project |

Check this flag if you would like Cync to use project numbers when calculating cross-age. The project number is used to group the invoices for a particular debtor. For example, a debtor has five invoices, then system shall group the invoices by project number and calculate the ineligibles for the project number. |

|

Calculated % on |

The option allows you to select a default variable, based on which the system calculates the cross aging % value. It includes 2 options; Ineligible and Aging.

If Ineligible option is selected, the system calculates the cross aging based on the defined Past due AR days. For more information related to C alculated % on calculations with examples, refer to Calculated on option is Ineligible.pdf

If Aging option is selected, the system allows to define cross aging buckets, based on which the Cross aging is calculated. |

|

Consider Cross Age buckets |

This option is enabled only when the Calculated % on is selected as Aging. For more information related to Consider Cross Age buckets calculations, refer to Calculated on option is Aging.pdf |

|

Cross Age Calculation |

The option allows to choose the cross age formula. It includes 2 options;

|

|

Allow Past Due > Debtor Balance |

Select the checkbox, if you would like to consider past due as ineligible when the past due value is greater than debtor balance. |

|

PAST DUE & AGED CREDITS |

The ineligible Reasons section, where you can setup the past due ineligible based on the invoice date, due date or both. |

|

Past Due AR Days |

This field allows you to establish the time period that should be used for calculating past due receivables. If Past Due AR days = 60, all the client’s invoices older than 60 days are considered as ineligible. The Past due is the sum of amount in the buckets greater than the "Past due AR days" value. For more information related to Past due calculations with examples, refer to Past Due AR days.pdf |

| Past Aging Date |

A field to select the past due ineligible based on the Invoice Date, Due Date or both dates. (Invoice Date or Due Date) The Past Aging Days field appears only if the following two conditions are met:

Refer to the Past Due AR Days Calculations PDF to learn how the calculations are performed for the three cases mentioned above. |

|

Past Invoice AR Days |

This field allows you to establish the time period that should be used for calculating past due receivables based on the Invoice date. The past due ineligible will be calculated based on the Invoice Date, provided that the due days are greater than the buffer days provided in this field. |

| Past Due AR Days |

A field that allows you to establish the time period that should be used for calculating past due receivables based on the Due date. The past due ineligible will be calculated based on the Due Date, provided that the due days are greater than the buffer days provided in this field. |

|

Past Due Amount |

This allows to specify the bucket values, depending on the selected option. It includes the following options;

|

|

Age Credit Amount |

Specifies the over bucket negative values, depending on the selected option. It includes the following options;

|

|

Age Credit Ineligible |

Specifies the condition if the age credit amount is included in the total ineligible based on the combinations of past due amount and age credit ineligible. It includes 2 options;

|

|

Include Negative Ineligibles in Total |

Select the box if you would like Cync to include negative ineligible calculations in the BBC. |

|

Calculate Aging |

The feature is applicable while calculating invoice aging for detail clients.

|

|

Invoice Aging Start On |

The feature is applicable when Calculate Aging feature is ON. It includes the following options:

For more information with aging calculations refer to Invoice Aging Calculations.pdf |

|

Move Future Aging into Current |

|

|

Payment Term over days |

Enter the payment term over days. This option is available only when Aging starts On is selected as Due Date and Due Date+1.

The maximum character limit is 4. If the character limit exceeds more than 4, then the system shows an error notification. Refer to the screenshotRefer to the screenshot

The special character and alphabets are not allowed. If the Payment Term Overdays field is filled up with any special characters/alphabets or not filled out, then the system shows an error notification. Refer to the screenshotRefer to the screenshot

|

|

Ineligible Calculation at Borrower or Division Level |

Check in type of ineligible calculation select either borrower level or division level. |

|

Bring Forward Manual Ineligible |

This allows you to import the manually entered ineligible reasons from current or specific BBC to next BBC. It includes the following options:

For more information refer to ABL → BBC Review / Manual Input → Ineligible Summary page. |

|

AP Required |

Specifies whether AP file is uploaded or not uploaded. Select the checkbox, to view whether the file is uploaded or not uploaded. The details can be viewed under BBC Management Report. Clear the checkbox to disable to AP uploaded option. The AP required displays 'No' under BBC Management Report. |

|

AR Exclude % on |

AR exclude ineligible amount is calculated, If the ineligible reason Excluded is selected under Ineligible Calculations page. Based on the option selected under AR Exclude % on, the system calculates ineligible for AR Exclude reason which is needed to calculate BBC. It includes the following options:

The AR Exclude % value = $4500 ($4500 * 50%) = 2250 and AR Exclude Value = $1000. Greater of two i.e. $2250, the same amount is considered as AR Exclude ineligible amount. AR Exclude ineligible amount = $2250.

Then AR Exclude % value = (6055-5000)*50 % = 1055 *50% =527.5. AR Exclude ineligible amount = $1055 (The system considers remaining debtor balance as Excluded). |